Summary:

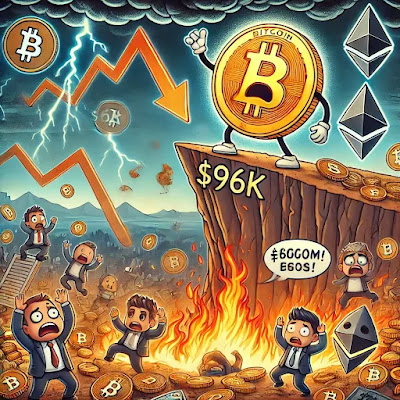

The cryptocurrency market is facing significant headwinds, with Bitcoin (BTC) dipping below $96,000 for the first time in weeks. The drop, triggered by the Federal Reserve's cautious stance on interest rate cuts, has led to $680 million in outflows from Bitcoin ETFs and $800 million in market-wide liquidations.

Key Developments in Bitcoin ETFs

- U.S. spot Bitcoin ETFs experienced $680 million in outflows on Dec. 19, breaking a 15-day streak of inflows that totaled $6.7 billion.

- Fidelity’s FBTC led the outflows with $208.55 million, followed by Grayscale’s Bitcoin Mini Trust ($188.6 million) and ARK 21Shares’ ARKB ($108.35 million).

- Despite outflows, trading volume surged to $6.31 billion, highlighting heightened market activity amid volatility.

- Ethereum ETFs also saw outflows of $60.47 million, though cumulative inflows for the year remain positive at $2.4 billion.

Market-Wide Liquidations and Volatility

- Over $846 million was liquidated in the past 24 hours, impacting nearly 243,000 traders.

- The largest single liquidation was a $15.8 million ETHUSDT position on Binance.

- Bitcoin's market cap now stands at $1.88 trillion, with trading volume exceeding $102 billion in the last 24 hours.

Federal Reserve’s Role in the Downturn

- The Fed announced a 0.25% rate cut but projected only two more cuts in 2025, signaling a hawkish approach.

- Inflation is expected to meet the 2% target by 2026-2027, dampening market optimism.

- Chair Jerome Powell's comments spurred a sell-off, leading to a 4.5% drop in the broader cryptocurrency market, now valued at $3.51 trillion.

Altcoin and Broader Market Impact

- Ethereum (ETH) dropped 8.1% to $3,378, while altcoins like SOL, ADA, and LINK suffered 15%-20% losses.

- The CoinDesk 20 Index plunged 10%, reflecting a broader market sell-off.

- Leveraged positions across crypto assets saw $1.2 billion in liquidations, with long positions making up the majority.

Hope for Recovery?

Despite the bearish momentum, some analysts point to potential recovery based on historical patterns. Santiment notes that previous dips below critical levels have often preceded sharp rallies. For example, BTC rose by over 25% within days following a similar correction earlier this year.

However, technical metrics indicate that the breach of key support zones, such as the $97,500 level, could lead to intensified selling pressure. Investors are urged to monitor macroeconomic indicators and manage their positions carefully.

Closing Thoughts:

The market correction underscores the crypto market's volatility, compounded by macroeconomic factors like Federal Reserve policy. While historical trends suggest potential for recovery, cautious sentiment prevails as traders navigate the uncertain landscape.

Comments

Post a Comment